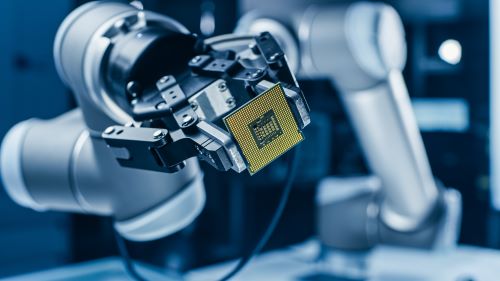

CHIPS Act of 2022: Bringing Semiconductors Onshore

The United States currently manufactures only 12% of the world’s semiconductors, a stark difference from 37% in years past. The decrease in production, paired with the inability to produce more advanced chips domestically, has created an undesirable foreign dependency. When there are shortages, it can have a chilling economic effect. For example, the recent chip shortage had a significant impact on the auto industry. It led to production cuts, delayed shipments, factory shutdowns, and a sharp increase in new car prices. These chips are used in dozens of everyday items, including mobile phones, digital cameras, televisions, washing machines, refrigerators, and even LED bulbs.

The widespread use of semiconductors has made it imperative to develop onshore manufacturing to ensure competitiveness and maintain national security. The CHIPS Act of 2022 (Act) aims to address this deficit by providing targeted funding and incentives for domestic semiconductor manufacturing. This includes creating a CHIPS for America Defense Fund, CHIPS for America Workforce Fund, and several other programs. To help clients, prospects, and others, Klatzkin has summarized the key details below.

What is the CHIPS Act of 2022?

The Act builds on a previous program that brought together the Department of Commerce (DoC), Department of Defense (DoD), and Department of State (DoS) to authorize the development of domestic semiconductor manufacturing. It also provides appropriations necessary to achieve this goal. It offers safeguards that ensure those who receive federal funds are unable to build advanced semiconductor production facilities in foreign countries.

How is the USA Telecom Act related to the CHIPS Act?

The CHIPS Act of 2022 has appropriated the needed funds to implement the USA Telecom Act, which aims to strengthen the global telecommunications supply chain and reduce reliance on companies such as Huawei. This will be accomplished by diversifying the supplier base for telecommunications equipment and services, which can improve the reliability of infrastructure even in the event of disruptions or compromises to a supplier.

In particular, the USA Telecom Act is interested in restricting the use of equipment and services from companies with close ties to the Communist Party of China. Restricting equipment and services from companies like Huawei in critical infrastructure can mean reducing the likelihood that these companies could be used to collect intelligence or conduct cyberattacks on behalf of the Chinese government.

Funding will also be used to accelerate the development of an open-architecture model (OpenRAN) that allows different vendors to provide different parts of the network, which promotes innovation and competition.

Key Appropriations

In total, $54.2 billion in appropriations have been set aside for these efforts, broken down as follows.

CHIPS for America Fund

- DoC Manufacturing Incentives: $39 billion will go to expanding, building, and modernizing facilities where semiconductors can be made, assembled, tested, researched, and packaged. $2 billion of these funds will be allocated specifically for mature semiconductors. Direct loans and loan guarantees can also be included in this incentive program of up to $6 billion.

- DoC Research and Development: $11 billion is allocated to research and development, including creating a public-private National Semiconductor Technology Center (NSTC). It will also be used to create a National Advanced Packaging Manufacturing Program for advanced assembly, test, and packaging (ATP) capabilities; the Manufacturing USA Semiconductor Institute with partnerships in industry, government, and academia to research virtualization; and Microelectronics Metrology R&D, a National Institute of Standards and Technology (NIST) program.

- CHIPS for America Workforce and Education Fund: $200 million will go to supporting the domestic semiconductor workforce by leveraging the National Science Foundation’s (NSF) activities.

- CHIPS for America Defense Fund: $2 billion for the development of the Microelectronics Commons by the DoD, which will include the transition of semiconductor technologies from laboratory to fabrication plant, as well as prototyping and workforce training. DoD-unique applications can be included in this scope.

- CHIPS for America International Technology Security and Innovation Fund: $500 million will go to the DoS, working in tandem with several other agencies to support international semiconductor supply chain activities, international information technology security, and communications security.

New Tax Incentive

A new federal tax credit has been introduced to incentivize semiconductor manufacturing. The Advanced Manufacturing Investment Credit provides a 25% federal tax credit for investment in eligible manufacturing activities. This includes both semiconductors and the specialized tools necessary in production. The credit is available for property placed into service after December 31, 2022, and for which construction started before January 1, 2017.

Contact Us

The CHIPS Act calls for significant investment in semiconductor manufacturing and includes several incentives for eligible activities. If you have questions about the information outlined above or need assistance with another tax or accounting issue, Klatzkin can help. For additional information call 609-890-9189 or click here to contact us. We look forward to speaking with you soon.